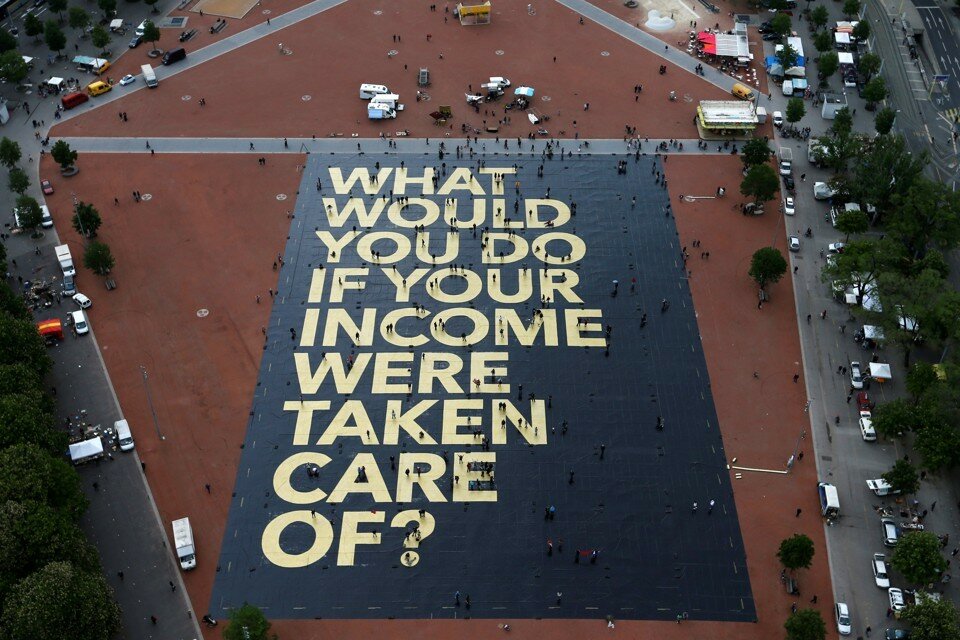

What if everyone on the planet received a guaranteed income whether or not they worked?

That’s the idea behind the universal basic income (UBI) – and it is gaining ground globally. Government officials, some technology executives, philanthropists and academics from every continent are championing the idea as a way to combat rising wealth inequality and provide an income floor as new technologies are seen decimating jobs in the future. However, the programme’s effectiveness and affordability are far from settled discussions. Political hurdles must also be overcome for it to become reality.

This year, UBI was a hot topic at the World Economic Forum in Davos, Switzerland, following discussion in 2016 of a “world without work.” In January, Finland launched a pilot programme to give 560 euros for two years to 2,000 unemployed adults that replaces some social benefits. They will not lose the income even if they find a job. India’s government has endorsed the idea, too. Canada’s Ontario province is planning a pilot programme, and last year the Swiss put UBI to a referendum, but it failed.

In the U.S., some Silicon Valley titans are championing the idea. At the recent World Government Summit in Dubai, Tesla CEO Elon Musk said autonomous technology will lead to high levels of unemployment and so some form of UBI is “going to be necessary.” EBay co-founder Pierre Omidyar is testing the idea in Kenya while tech startup incubator Y Combinator is launching a pilot programme in Oakland, Calif. But others, such as Microsoft co-founder Bill Gates, remain unconvinced, noting that countries, even the affluent U.S., cannot afford it and so governments should focus first on helping the poor, elderly and disabled.

The views of Y Combinator president Sam Altman exemplify the altruistic fervor behind UBI. “We think everyone should have enough money to meet their basic needs – no matter what, especially if there are enough resources to make it possible,” he wrote in a blog post. “We hope a minimum level of economic security will give people the freedom to pursue further education or training, find or create a better job, and plan for the future.”

UBI does have some practical and philosophical justifications, according to Wharton management professor Matthew Bidwell. Philosophically, “one argument is that all of us are benefiting from the investments in society that were made by prior generations. The wealth of every one of us is underpinned by the technological advances and institution-building of the past. A UBI allows the benefits of society to be shared across all of us.”

Practically speaking, Bidwell adds, “it is simpler to implement than other forms of welfare because it doesn’t require means testing [for eligibility]. Other forms of welfare benefits can also reduce incentives to work, because benefits get withdrawn as earned income goes up. UBI does not have that problem.”

While talk of providing a guaranteed income has been around for many years – five major experiments were conducted in the U.S. and Canada in the 1960s and 1970s that yielded mixed results – the idea has resurfaced in recent years as concerns grew that self-driving technology, artificial intelligence and robotics will destroy many jobs. There is no consensus on how big the impact will be, but one 2013 estimate out of Oxford University is that 47% of U.S. jobs are at risk of being automated in 20 years.

However, Peter Cappelli, Wharton management professor and director of the school’s Centre for Human Resources, says he has yet to see evidence that robots are going to cause massive joblessness. Observes Kent Smetters, Wharton professor of business economics and public policy: “The evidence is that robotics is a labour complement and is increasing skilled wages. While robotics are replacing some lower-skilled jobs, the most efficient response is to not kill the golden goose but to make sure we have job training programs that are effective in increasing skills.”

‘Impossibly expensive’

From the point of view of economists, a UBI is not feasible. “Thoughtful liberals and conservatives trained in economics are almost universally against the idea,” Smetters says. Former Clinton official and economist Laura Tyson writes that “a UBI for the United States is as fanciful as President Donald Trump’s border wall: It would be prohibitively expensive; and it would not solve the problems that it is meant to address.” UBI would benefit higher-income workers and distracts from immediate problems such as stagnant wages and persistent poverty. Instead, the U.S. should expand benefits for existing programmes such as Medicaid, critics argue.

Meanwhile, conservative economist Martin Feldstein opines that a universal income would be “impossibly expensive.” The former Reagan official says paying for the programme without raising the deficit would require “doubling the personal income tax.” A UBI that pays every American $10,000 a year would cost about $3 trillion, Smetters says. Conservative economists do not like it because it would harm economic growth, he adds.

“Arguments for a UBI are coming more from political libertarians who see it as simplifying government redistribution as well as political liberals who just like the idea of redistribution,” Smetters adds. However, “because of the cost, it will generally weaken the ability to target the poor by diluting the spending to everyone, which is why liberal economists don’t like it. In the end, any serious proposal has to confront the math, and I don’t see it passing in the United States during my lifetime,” he says.

Another issue is that to offer a meaningful level of UBI, taxes have to be high enough to pay for it. Low taxation will not work. “Either we end up with a very low UBI, which would leave those reliant on it in abject poverty; or we end up with a higher UBI and far greater taxes than we are used to paying,” Bidwell says. “I find it very hard to envision political support in this country for that kind of radical increase in taxation.” However, he adds, some rich nations with high tax rates could make this work.

Instead of a UBI to help the poor, Feldstein recommends the “negative income tax” plan advocated by two Nobel laureates, conservative economist Milton Friedman and James Tobin, a liberal Yale economist. Their idea is for all households under 65 years old to get enough money to keep them out of poverty if they had no other income; funding would decline as their income rose. Feldstein sees this as “the best way possible to achieve simplicity, inclusiveness and moderate taxpayer cost.”

The U.S. never adopted the “negative income tax” plan because of concerns that a family of four would get enough money to entice many to go on the dole, according to The New York Times. However, Congress did pass a modified version of it in the form of the earned income tax credit (EITC), where only working people received benefits. Smetters favours this plan, which has bipartisan support and is “very effective at redistribution and does not have a lot of red tape” unlike other aid programmes.

Adds Cappelli: “Most countries already have the idea of a safety net to provide income.” For example, Social Security payments in the U.S. are a form of guaranteed income. “The issue is the amount and the eligibility of [UBI]. In the U.S., the importance of work for those who can do it is still fundamental, so I don’t see any prospects for a guarantee of income for those who can otherwise work,” he says. “What might expand in the U.S. is the idea of earned income tax credits, where we supplement the income of those who are working but don’t earn enough to live.”

Bidwell notes that “people are right to be concerned about how automation is changing the labour market, and the implications for inequality. I’m not sure, though, that [a UBI] is the solution.”

Bundling UBI with EITC

Benjamin Lockwood, Wharton professor of business economics and public policy, favours the idea of offering a guaranteed basic income, which he says is a better term than UBI. “We seem to have agreed – maybe tacitly – as a nation that it’s important to not let fellow citizens starve to death or die of exposure when they fall on hard times, go through a life transition, etc.”

Currently, the U.S. already provides aid to low earners by providing such things as food stamps, housing vouchers and various refundable tax credits. “Unfortunately, that’s created a hodgepodge of programmes that are complicated to apply for and to administer, and so they often don’t reach the people who need the most,” Lockwood notes. “Replacing some of those programmes – except Medicaid – with a guaranteed basic income could both simplify and firm up our current patchy safety net.”

A guaranteed income “is part of the answer,” Lockwood says. “When automation or globalisation makes skills obsolete, a safety net can be very helpful. Right now, many displaced workers take early retirement, some turn to disability insurance. A basic income could provide support without prohibiting recipients from developing new skills and seeking other employment.” He adds that the government should also encourage people to learn new skills and re-enter the workforce because it provides social engagement and boosts self-regard.

Like Cappelli, Lockwood favours an expanded EITC – he has done research on ways to improve it – but prefers to combine it with a “modest” guaranteed basic income to “actually raise wages and spur growth.” He sees it working two ways: “First, displaced workers would feel more secure and would be motivated to invest in developing skills in other industries, raising their employability and wages, rather than taking early retirement, seeking disability insurance or just cutting back on spending. Second, companies and policy makers would be less hesitant to adopt and encourage labor-saving technologies such as self-driving trucks, for example, if they were confident that workers had a safety net of support – and that would tend to encourage economic growth.”

In developing nations, a basic income could be beneficial especially to people on the ropes. “There is a growing body of evidence that cash grants provide useful resources which people can use as they see fit, and so cash is often more effective and generates a higher ‘return on investment’ than other sorts of international aid,” Lockwood points out. In the end, “that suggests that even a small basic income could do a lot of good.”

AUTHOR: http://www.leader.co.za

SOURCE: http://www.leader.co.za

IMAGE CREDITS: http://financialexchangeshow.com

SA Business Index

SA Business Index

Comments

Your Turn To Talk